By Mike Mason, Chief Operating Officer at Earth Blox

In the past, sustainability used to be a passion project. Something bolted onto the business, championed by the CSO, and filed under ESG. Today, that's no longer enough. When I'm brought in to speak with companies now, my first call isn't with the CSO alone, the CFO is there too.

Why? Because climate risk has evolved. It's not just about environmental responsibility. It's about operational viability and financial success. It impacts every part of a business.

Let me explain.

Tropicana: The canary in the commercial coal mine

During a recent presentation, I used the example of Tropicana. Most people see the brand on supermarket shelves and assume it's thriving. But dig a little deeper, and you'll find a sobering reality: $30 million in emergency loans, a 4% drop in revenue, and margins so thin they're bordering on negative. They're not just struggling. They're flirting with bankruptcy.

This isn't just bad luck. It's the consequence of a brittle supply strategy. Tropicana, like many legacy firms, has historically sourced the bulk of its oranges from Florida and Brazil — regions that are now climate hotspots, susceptible to increasingly severe droughts.

The irony? These patterns were predictable. Climate science has been flagging risks in South America for years. However, without integrating that knowledge into commercial planning, even a household name like Tropicana is exposed.

Sustainability is now commercial strategy

This is the pivot every business needs to understand: environmental sustainability is business sustainability.

When companies fail to account for nature-related risks, they're not just making poor ESG choices. They are making poor commercial decisions. If your supply chain collapses or your agricultural yield drops to record lows, the impact is immediate and financial.

And yet, I still see hesitation in boardrooms. I hear: "But that's Tropicana. That's not us." Or "We still see the product on the shelf, how bad can it be?" The trouble is, that by the time the impact becomes visible to consumers, it's already too late for the balance sheet.

The real data problem: Relevance, not access

Another common myth is that businesses don't act because they lack data. That's not true.

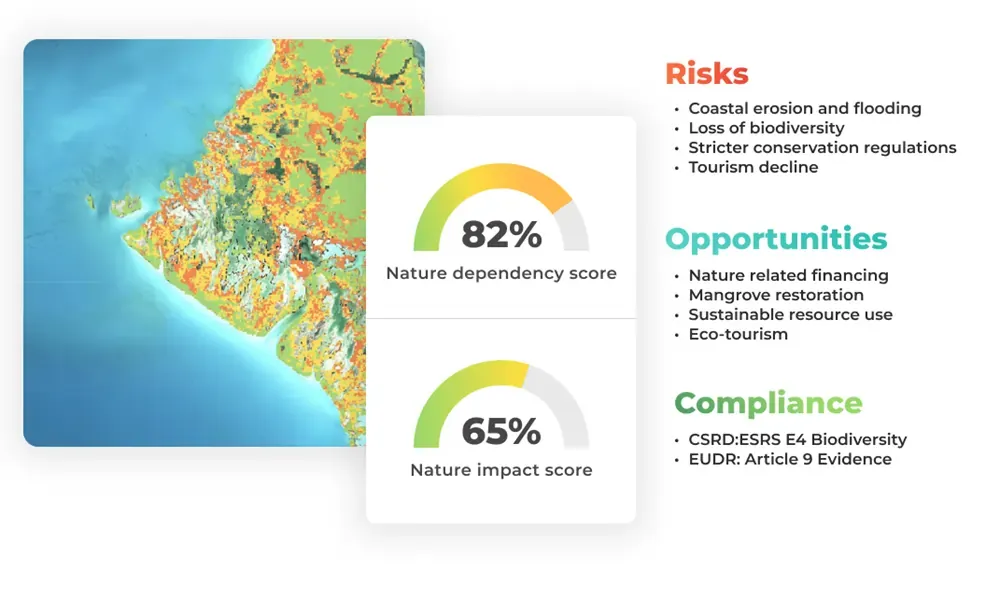

We're swimming in data from government sources, commercial satellites, and internal systems. The real problem is relevance: extracting the bits of information that help you understand risk, make decisions, and take action.

Businesses don't need more spreadsheets. They need clarity. They need a way to ask: "How does this environmental factor impact this part of my portfolio?" And get a clear, actionable answer.

Beyond compliance: The case for risk mitigation

Too many still see nature-based data as a tool for ticking regulatory boxes. But compliance is only 10% of the story. The real value lies in risk mitigation and opportunity creation.

Take the agri-business we worked with. By overlaying biodiversity data with yield performance, we uncovered a powerful insight: farms with higher biodiversity were also the most productive. That meant investing in nature restoration wasn't just good for the planet. It was good for the bottom line.

When you can show a direct link between environmental health and business outcomes, sustainability shifts from a cost centre to a value driver.

From basement reports to boardroom decisions

Traditionally, companies have relied on consultants to produce environmental reports. The model? Lock some experts in a basement and wait a year for a PDF.

But that's slow, opaque, and inherently selective. Worse, there's a global shortage of the expertise needed to produce these reports.

That's why tools that democratise data access are so important. We need systems that allow people with business knowledge — the folks who understand customers, operations, and commercial strategy — to explore risks and model outcomes directly.

This isn't about replacing consultants. It's about empowering them to do more and, at the same time, scaling insights by putting sustainability knowledge in the hands of the people running the business.

The bottom line

If there's one message I leave behind in every meeting, it's this: Sustainability is no longer just a CSR initiative. It's also financial strategy. And if you're not factoring climate and nature risk into your business decisions, you're not just behind the curve. You're walking blindfolded into a storm.

The convergence of climate, nature, and finance isn't theoretical anymore. It's here. And it's reshaping the boardroom agenda, one disrupted supply chain at a time.

Mike Mason is Chief Operating Officer at Earth Blox. Mike brings 30 years of experience building world-class operations in technology companies and driving value for clients. His approach has ensured the successful growth and exit of several businesses, including TVSquared and LBi.