Richard Carter, CEO and Founder of Lopay, knows firsthand how hidden fees quietly eat away at small business profits. For decades, global payment giants like Chase, Bank of America, and Clover have charged businesses steep percentages of every transaction. For a company already managing tight margins, those fees act like an invisible tax. Lopay, launched in January 2022, was designed to change that story. Today, more than 50,000 small businesses, from taxi drivers and barbers to builders and market traders, are choosing Lopay as a smarter, fairer alternative.

The Invisible Tax: Why Card Fees Hurt

Every time a customer swipes a card, business owners lose a percentage of their hard-earned revenue. For a company processing $250,000 a year, traditional providers may take tens of thousands in fees. Lopay offers relief by charging up to 60 percent less than major competitors. Those savings can translate into thousands of dollars annually, money that stays in your business instead of vanishing into bank coffers.

Imagine running a business that brings in $250,000 annually. With traditional card fees of about 3 percent, you could lose $7,500 each year. Lopay’s lower fees could save you nearly $5,000 annually: money that could fund new equipment, marketing campaigns, or simply help stabilize your cash flow.

Post-Cashless America: What Comes Next

Cash usage is declining, and card usage is reaching a plateau. Business owners are asking: what comes next? Richard Carter believes the future lies in account-to-account payments, instant settlements, and flexible checkout options. Lopay is already ahead of this shift. Unlike the slower-moving giants, Lopay provides instant payouts, available 24/7, including weekends and holidays. This gives entrepreneurs continuous access to their money when they need it most.

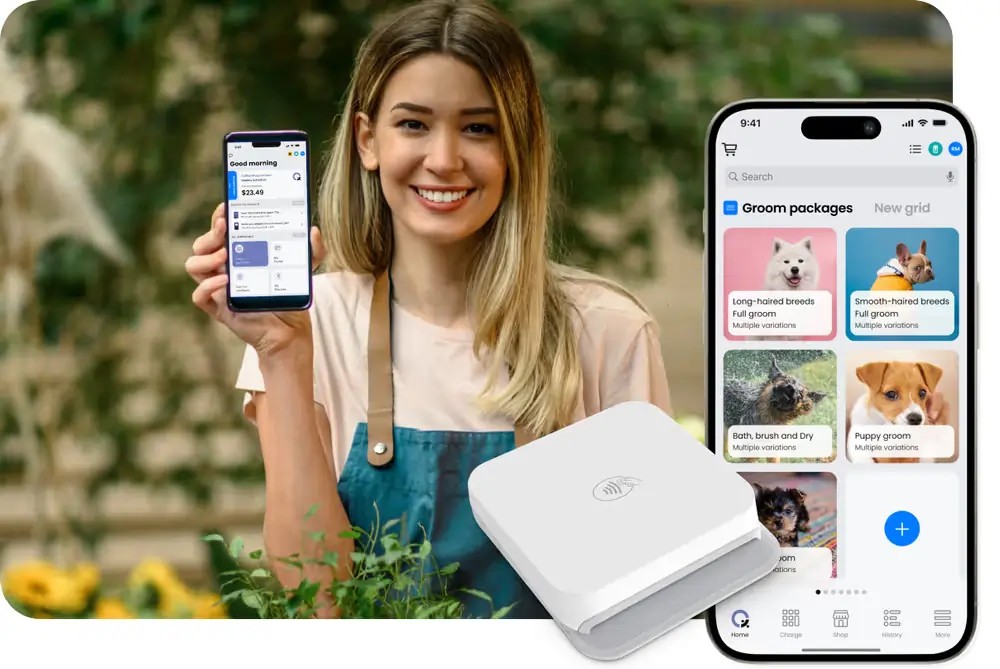

Lopay also comes with free POS software and powerful integrations, offering a complete toolkit that adapts as your business grows. Whether you are a sole trader or scaling into a multi-location business, Lopay meets you where you are and grows alongside you.

“Venmo’s Not Enough”

While peer-to-peer apps like Venmo work for splitting a dinner bill, they fall short for serious merchants. They lack the professional-grade features that business owners need, such as transparency, scalability, and real-time settlement. Lopay fills that space by combining ease of use with business-focused tools. There are no contracts, no fixed costs, and no surprise fees, just a clear, reliable system built to support you.

For independent business owners seeking more than just a digital wallet, Lopay offers a solution that combines personal convenience with professional reliability.

Building Trust and Awareness

What sets Lopay apart is not only cost savings but also its commitment to supporting small businesses directly. With a 4.9-star app rating and growing trust across industries, Lopay has quickly become the go-to partner for entrepreneurs. Richard Carter and his team designed Lopay with feedback from real users, making sure every feature addresses a genuine need.

For small and medium-sized business owners, Lopay offers a chance to regain control. In a market where payment giants dominate, Lopay brings fairness, transparency, and progress to the table.