Written by Vaneet Chathey

Financial institutions are under pressure to reduce risk, maintain uptime, and ensure compliance—all while increasing efficiency. By identifying opportunities to automate internal processes, the financial sector can achieve operational resilience through real-time incident detection, automated triaging, predictive alerting, and more.

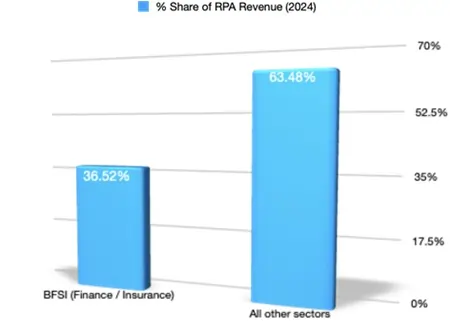

Many financial leaders recognize the value of automation. Respondents to SMA Technology’s 2024 State of Automation in Financial Services survey of 580 U.S. banking, credit union, and insurance executives ranked automation’s importance to their organization’s success an average of 8.5 out of 10. Automation is already widely used in the finance industry. According to Precedence Research, banks and insurance companies accounted for approximately 36.5% of all spending on robotic process automation (RPA) (Figure 1).

While automation tools aligned with governance and compliance needs can reduce high-priority incidents, improve response times, and reduce human error, they also require careful, intentional implementation. When financial institutions approach automation with a strategic mindset and robust technical foundations, they build sustainable, resilient operations that balance innovation with control.

Benefits to financial institutions

A primary benefit of automation is time efficiency. For example, daily system tests that typically take an employee an hour or more are completed in minutes with pre-scripted automation tools. This is crucial for avoiding delays in detecting any errors within financial operations, as it frees analysts and operations staff to focus on issues uncovered during the tests rather than spending time finding them.

Figure 1: Adoption of robotic process automation (RPA) in the financial sector is growing rapidly. Image courtesy of Vaneet Chathey.

Automation also increases accuracy and reduces the chance of human error by enforcing standardized processes and procedures. Once a script is written, implemented, and tested, it should continue to function consistently without manual intervention, thereby reducing variability and improving reliability. These benefits also indicate a significant shift toward using automation in core jobs like risk control, trade monitoring, and compliance reporting.

An additional benefit is that automation contributes to system stability and reduces downtime by predicting operational problems. Automation powered by machine learning (ML) can analyze historical data to detect patterns and predict when anomalies may occur, such as spikes in server demand or transactional bottlenecks, that often precede failures. This approach allows institutions to take action before problems escalate. During periods of high volatility, automation enables dynamic scalability. Infrastructure and resources can be increased automatically to meet demand during periods of high stress or volume and scaled back during quieter periods, thereby optimizing costs and reducing the burden on personnel.

Uses in finance

Applications of automation can differ across financial institutions, but there are some key areas where it consistently adds value. Routine system checks and reports performed daily, weekly, or monthly can be automated. This helps ensure systems are running smoothly and problems are caught early. Automation also removes the need for manual reviews, making oversight more frequent and reliable.

Real-time monitoring and incident detection are also key functions of automation. By scanning for unusual activity across databases, applications, or payment systems, automation tools can immediately trigger alerts and stay ahead of outages or security incidents.

Compliance checks and reports also benefit significantly from automation. Reports are generated on time and formatted correctly to minimize the risk of errors or delayed submissions. They can verify that internal systems adhere to evolving regulatory standards, reducing audit-related risks and ensuring compliance.

Best practices in automation integration

It’s essential to strategically integrate automation into financial operations. One best practice is to use application programming interfaces (APIs) to connect modern automation tools to older infrastructures. APIs provide the flexibility needed to automate tasks without completely overhauling legacy systems.

When introducing automation, it’s best to adopt a phased approach. Rather than attempting to automate all processes simultaneously, organizations can start by automating low-risk processes, such as internal reports or job scheduling, where there is no risk of reputational loss if challenges occur. These tasks have a limited negative impact while processes are being refined and before they are ultimately scaled to more sensitive functions.

Involving cross-functional teams is essential to the implementation process. Successful automation rollout plans benefit from input from infrastructure teams, financial database administrators, security experts, web development teams, and leadership stakeholders. Incorporating feedback from multiple parties increases the chances that workflows align with operational and compliance needs while reducing unintended disruptions. Teams can consider automation tools that interact with graphical user interfaces (GUIs). GUI-based automation enables financial institutions to automate tasks even when back-end access isn’t available, expanding the number of tasks that can be streamlined.

Finally, it’s vital for institutions to determine whether automation initiatives should be managed internally or with the help of third-party partners. External providers offer expertise and faster deployment timelines, while internal teams provide deeper institutional knowledge and control. The right choice depends on the institution’s goals, resources, and tolerance for risk.

Measuring success in automation integration

Once automation processes are deployed, it’s essential for organizations to measure and optimize their performance. The use of clear metrics and benchmarks is pivotal for assessing effectiveness. Key performance indicators include:

● Processing time saved. Measure how much faster a process runs compared to manual execution. This reflects the efficiency gains achieved.

● Manual intervention rate. Track how often human intervention is required to fix, monitor, or update automated processes. Lower rates indicate stronger automation design and reliability.

● System uptime. Monitor the availability and reliability of automated systems. Consistently high uptime demonstrates operational stability.

● Error rates. Measure how often automated processes produce errors. This helps identify scripts or workflows that may need refinement.

By consistently tracking these metrics, institutions can identify areas for improvement and adjust and optimize their automation strategies over time.

Partnering people with automation

Automation in financial operations is not about sidelining people—it’s about empowering and elevating them. By automating repetitive, error-prone tasks, teams gain the freedom to focus on more critical tasks such as strategic planning and innovation. Even as automation tools are integrated, the human element remains essential for oversight and decision-making. With the right balance, automation does not function as a replacement but becomes an ally in intelligent collaboration to build resilient, agile financial operations.

About the Author:

Vaneet Chathey is a technology operations and risk management leader with more than 18 years of experience in the investment banking sector. He has successfully driven operational resilience initiatives at global financial institutions, achieving system uptimes exceeding 99.5% and delivering 100% compliance with regulatory standards. His expertise spans proactive monitoring, automation frameworks, incident management, and technology governance across complex, high-stakes environments. Vaneet holds a Master of Commerce from MDS University and is certified in project management (PMP) and ITIL. Connect with Vaneet on LinkedIn.